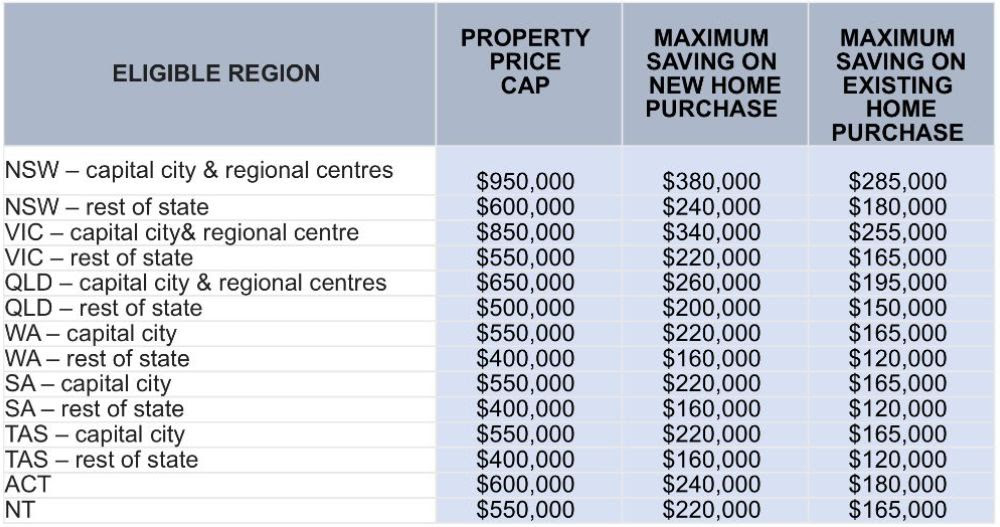

| Labor Party has promised that it will cut the cost of buying a home by up to 40 per cent for 10,000 Australians per year. Launching a new program called “Help to Buy“; If elected on May 21 Albanese Labor Government will help Australians buy a home with a smaller deposit, a smaller mortgage and smaller mortgage repayments. Leader of the Australian Labor Party, Anthony Albanese said, “After nine long years in Government, housing affordability has only got worse under the Liberal-National Government. “Help to Buy is part of Labor’s plan to tackle the housing crisis.” Labor Party claims in some parts of Australia this will cut the cost of a mortgage by up to $380,000. This election campaign pitch is for people who find it harder to buy a home today than ever before. “Help to Buy“ has been designed for big cities and the regions keeping in mind the distinctive needs of residents. The biggest drop in home ownership is amongst Australians on low and modest incomes who struggle to enter the market and miss out on the great Australian dream. Forty years ago, almost 60 per cent of young Australians on low and modest incomes owned their own home. Now, it is only 28 per cent. An Albanese Labor Government promises to provide eligible homebuyers with an equity contribution of up to 40 per cent of the purchase price of a new home and up to 30 per cent of the purchase price for an existing home. The homebuyer will need to have a deposit of 2 per cent and qualify for a standard home loan with a participating lender to finance the remainder of the purchase. The following table shows how much people will save on their mortgage under Labor’s Help to Buy in different cities and regions.  |

| Note – Regional centres include Newcastle & Lake Macquarie, Illawarra, Central Coast, North Coast of NSW, Geelong, Gold Coast and Sunshine Coast. According to Shadow Treasurer, Jim Chalmers, “There is a housing crisis in Australia – it’s harder to buy a home than ever before. It’s harder in the big cities and harder in the regions. “It’s harder for first home buyers and harder for many older Australians. Many people on modest incomes have been forced to give up the Australian dream. Help to Buy will address this.” Homebuyers will also avoid the need to pay Lenders Mortgage Insurance (LMI), representing an additional saving, depending on purchase location, of potentially more than $30,000. This will help many Australians on low and modest incomes to buy a home with a much smaller mortgage that they can afford to pay rather than renting for the rest of their life. During the loan period the homebuyer can buy an additional stake in the home when they are able to do so. The homebuyer will not be required to pay rent on the stake of the home owned by the Federal Government. This scheme is not just for first homebuyers, it’s for other Australians who need a helping hand as well. Help to Buy will be available to Australians with a taxable income of up to $90,000 for individuals and up to $120,000 for couples. Homebuyers must be Australian citizens and not currently own or have an interest in a residential dwelling. Help to Buy will make money for the Government as the Federal Government will recover its equity and its share of the capital gain when the house is sold. Help to Buy will cost around $329 million over the forward estimates. National Housing Supply and Affordability Council An Albanese Labor Government will also establish a National Housing Supply and Affordability Council, to ensure the Commonwealth plays a leadership role in increasing housing supply and improving affordability. The Council will be advised by experts including from the finance, economics, urban development, residential construction, urban planning and social housing sectors. More land supply and better land use planning will improve housing affordability and provide a boost to national productivity and economic growth – but the only way to achieve this is by partnering with the States and Territories. The Council will set targets for land supply, in consultation with States and Territories. It will also collect and make public nationally consistent data on housing supply, demand and affordability. The Council will also have a key role in developing Labor’s National Housing and Homelessness Plan – something the Morrison Government has refused to do. Doubling foreign investment fees and penalties To pay for housing affordability polices, Labor will double foreign investment screening fees and financial penalties. These changes will commence from July 2022 and raise around $445 million over the forward estimates. Shadow Minister for Housing and Homelessness Jason Clare said, “It’s harder to buy, harder to rent and there are more homeless Australians than ever before. “This will help a lot of Australians buy a home with a smaller mortgage that they can afford to repay, instead of renting for the rest of their lives.” |

However, Prime Minister Scott Morrison has accused Mr Albanese of trying to “take a cut” from potential homebuyers under the ‘Help to Buy’ scheme.

He claims that the plan would allow the government to purchase a slice of people’s property.

PM has suggested it was a money-making exercise.

“Our plan is for Australians to own their own home, not for the government and Anthony Albanese to own your home,”

Mr Morrison told reporters on Sunday.

The Prime Minister added Labor was “looking to make money” out of the proposed scheme.

“They will have equity in your home … I don’t have a plan to make money off of people buying their own home,” he said.

“Quite the opposite – I want them to own their own home.”